does instacart take out taxes for employees

Accurate time-based compensation for Instacart drivers is difficult to anticipate. Minimum Batch Payment.

All You Need To Know About Instacart 1099 Taxes

There will be a clear indication.

. The organization distributes no official information on temporary worker pay however they do. Instacart shoppers are paid a minimum amount for every batch or order they complete. Instacart 1099 Tax Forms Youll Need to File.

Like all other taxpayers youll need to file Form 1040. Find answers to Do they take out taxes from Instacart employees. But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the.

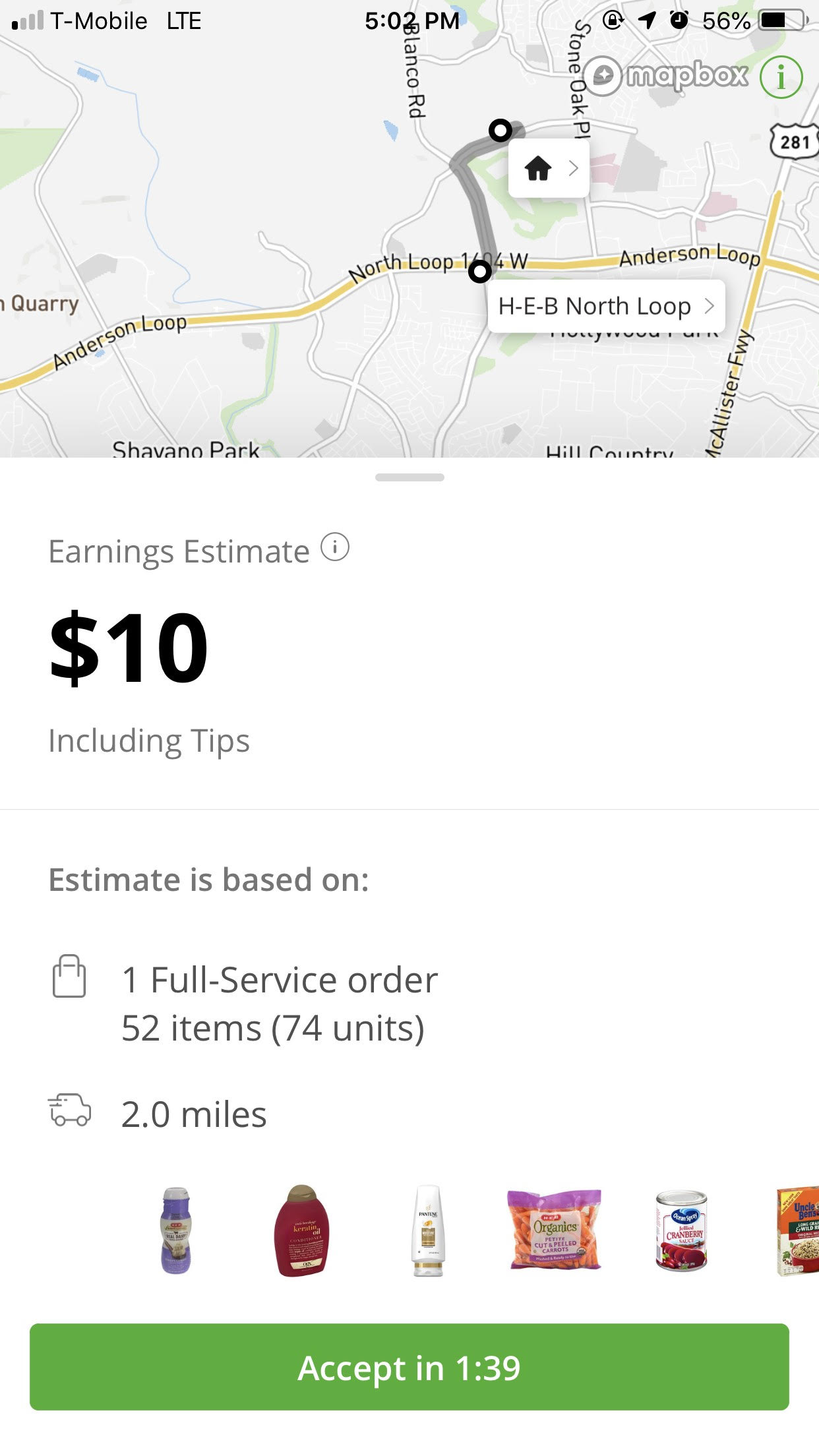

Fees vary for one-hour deliveries club store deliveries and deliveries under 35. January 16 2023 Pay estimated taxes for Sept 1 to Dec 31 Find out if you owe quarterly taxes here. This amount was previously 3 but after a PR snafu when changing up their payment structure once again the company increased the amount of the batch payments to between 7 and 10.

Are Instacart Shoppers employees or contractors. No taxes are taken out of your Doordash paycheck. Your employer covers the other amount totaling 153.

Get answers to your biggest company questions on Indeed. If youre an employee stop reading. This stuff applies just as much for Instacart Uber Eats Grubhub Postmates.

What Taxes Do Instacart Shoppers Need to Pay. But if you choose to work as an Instacart full-service shopper. What Taxes Do Instacart Shoppers Need to Pay.

Yes even as an independent contractor you are to report your earnings from working as an independent contractor at a 3rd party delivery driver Instacart UberEats. Instacart delivery starts at 399 for same-day orders over 35. This tax form summarizes your income for the year deductions and tax.

According to Glassdoor in-store Instacart shoppers earn an average of 13 per hour. Up to 5 cash back Order same-day delivery or pickup from more than 300 retailers and grocers. What documentation do I need to file my taxes.

As of December 2020 159 shoppers reported a range of earnings from 7 to 21 per. To pay your taxes youll generally need to make. For its part-time shoppers Instacart doesnt take out taxes and they file W-2s.

Answer 1 of 4. Instacart usually wont take out taxes since youre an independent contractor and have to pay estimated taxes. Plan ahead to avoid a surprise tax bill when tax season comes.

Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes. Can I use my Instacart card. Does Instacart take out employee taxes.

Instacart does not take out taxes for independent contractors. Download the Instacart app or start shopping online now with Instacart to get. As a self-employed individual youre considered the employer and employee and are responsible for paying the full 153 on.

Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes. How do I prove employment with Instacart.

What You Need To Know About Instacart Taxes Net Pay Advance

The Ultimate Tax Guide For Instacart Shoppers Stride Blog

As Instacart Looks To Expand Its Services It Takes Steps To Retain Talent Insider Intelligence Trends Forecasts Statistics

Instacart Q A 2020 Taxes Tips And More Youtube

What You Need To Know About Instacart Taxes Net Pay Advance

How Much Do Instacart Shoppers Make 2022 Update

What You Need To Know About Instacart Taxes Net Pay Advance

Delivery Taxes Guide How To File Your Taxes As A Doordash Instacart Uber Eats Courier

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

When Does Instacart Pay Me The Complete Guide For Gig Workers

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Driver Pay How Much Does Instacart Pay Shoppers

Instacart Help Center Checking Out With Your Ebt Card

Does Amazon Flex Take Out Taxes In 2022 Tax Forms Explained

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

When Does Instacart Pay Me The Complete Guide For Gig Workers

Instacart Changes How It Pays Shoppers But Many Say They Re Now Making Less Ars Technica

What You Need To Know About Instacart 1099 Taxes

Instacart Taxes How Taxes Work For Instacart Shoppers 1099 Cafe